The IR35 rules, also referred to as the “off-payroll working rules” or “intermediaries legislation”, are anti-avoidance measures designed to tackle abusive use of personal services companies (PSCs) by contractors.

In 2000, the onus to determine self-employed tax status in the public sector shifted from the contractor to the end client, marking a substantial reform in the regime. From April 2021, this was extended to the private sector, affecting all medium and large businesses in the life sciences sector that engage contractors or freelancers through PSCs.

While HMRC stated that it would support businesses to comply with the new rules, taking a “light touch” approach to penalties for the first year, this has now come to an end. Further enforcement is anticipated in this area, particularly in regards to the use of umbrella companies after the call for evidence issued at the end of 2021.

When do the rules apply?

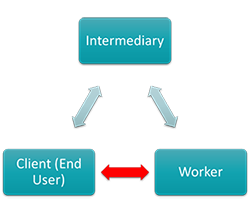

IR35 applies to individual contractors who work like employees but provide their services through intermediary entities (often PSCs) where, if that individual contractor had provided their services directly to the end customer, they would be regarded as an employee for tax purposes. The legislation looks beyond the contracts in place and instead considers the practical implications of an arrangement (i.e. the hypothetical contract shown by the red arrow in the diagram below).

Where IR35 applies, payments made to the intermediary must be subject to deductions of tax and employee national insurance contributions, plus the paying entity must account for employer’s national insurance contributions (and, if relevant, the apprenticeship levy). It is important to note that businesses must also continue to pay VAT on the gross fees invoiced by the PSC, which may require new procedures to be followed in finance departments in order to reconcile the VAT position and the IR35 consequences.

Where IR35 applies, payments made to the intermediary must be subject to deductions of tax and employee national insurance contributions, plus the paying entity must account for employer’s national insurance contributions (and, if relevant, the apprenticeship levy). It is important to note that businesses must also continue to pay VAT on the gross fees invoiced by the PSC, which may require new procedures to be followed in finance departments in order to reconcile the VAT position and the IR35 consequences.

What are the terms of the hypothetical contract?

The key criteria which are applied to determine whether the arrangement is a form of “disguised employment” or true self-employment are:

- Mutuality of obligation on both the individual and end user

- Right of substitution for the individual contractor

- Degree of control held by the end user over the worker

There are numerous additional factors to consider in each case, such as financial risk, length of the engagement, and equipment provision. Overall, the end user must take a holistic, and not a tick-box, approach when assessing the nature of its engagement with the worker.

Impact of the April 2021 IR35 reforms on life sciences businesses

Engaging contractors or freelance workers through PSCs is common practice in the life sciences industry. From April 2021, medium and large private businesses in the sector who do so will have needed to:

- Identify the workers impacted by the rules.

- Assess the underlying hypothetical contract between each worker and the end user.

- Decide the workers’ employment status, keeping records of the reasoning behind each determination, and communicate this to the worker in writing before he/she is paid – keeping in mind that workers have the right to appeal the determination.

The rules will also apply to complex labour supply chains (e.g. those involving multiple agencies) and to public sector bodies (who were already within the regime). Small private businesses (broadly those meeting at least two of the following tests: annual turnover of not more than £10.2m, balance sheet total of not more than £5.1m, and not more than 50 employees) will stay within the old regime, although the new rules will apply if they expand to become medium or large entities.

What actions should life sciences companies take to comply with the new rules?

Small companies

Small private companies in the life sciences sector who are expanding to become medium or large entities in the near future may wish to:

- Audit their labour supply chain.

- Identify who will have responsibility for implementing the rules within the business.

- Analyse the cost implications of status determinations.

- Adjust existing contracts and/or working practices to clarify in advance which workers are self-employed and which should be engaged formally as employees.

- Provide training within the business on any new processes, contract templates and controls to be followed.

- Communicate with affected workers about contract amendments, status determinations and any dispute resolution procedures.

Medium and large companies

Medium and large private companies in the life sciences sector, who have already implemented the new rules, should consider:

- Refreshing status determinations on a regular basis, and in particular when new contracts are signed or existing contracts are altered or extended

- Reviewing and updating their processes as legislation and guidance changes.

- Providing refresher training within the business at regular intervals on the processes, contract templates and controls to be followed.

Businesses concerned about the implications of the IR35 rules or how best to comply with them should contact their legal and tax advisors in the first instance.

Sarah Balchin

Sarah Balchin