The government plans to introduce a new digital services tax targeting big technology companies with revenues over £500m. A consultation on the detailed design and implementation of the tax is under way and is due to conclude on 28 February 2019.

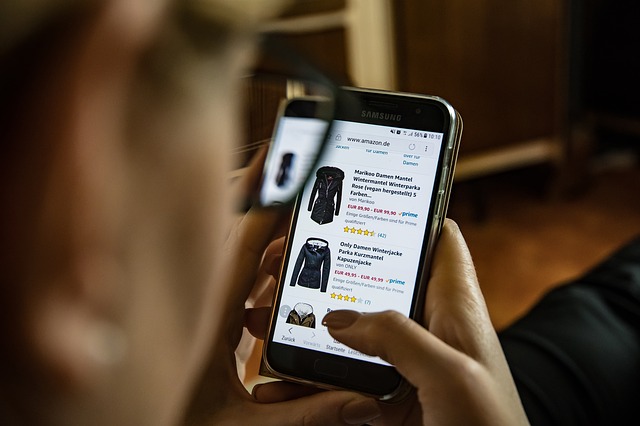

The tax, first proposed in the 2018 Budget, is intended to come into effect in April 2020 and is expected to raise over £400m by charging 2% on UK generated revenues from social media platforms, search engines and online marketplaces. This means companies such as Facebook, Google and Amazon could be caught by its remit.

It is unclear if the burden of the tax will fall on the consumer in the form of higher prices, although, the Chancellor, Philip Hammond, specifically stated that the tax is “not an online-sales tax on goods ordered over the internet…such a tax would fall on the consumers of those goods – and that is not our intention”.

The proposal comes after attempts to reach a consensus across the EU on a digital services tax failed with France and Germany abandoning plans for a digital services tax, in favour of a tax on online advertising sales. The UK government, not satisfied with the rate of progress, seems prepared to take unilateral action. It wouldn’t be the first to do so, with Spain planning to introduce a similar 3% tax in 2019.

Big tech companies, such as Amazon, have increasingly faced controversy over their complex multi-jurisdictional corporate structures designed to minimise their tax liabilities. In what appears to be an attempt to tackle this practice, the tax also potentially gives a lifeline to traditional bricks and mortar retailers by levelling the playing field.

The budget, whilst proposing this new tax, also included a reduction of business rates for businesses with a rateable value of £51,000 or less, aimed to benefit 90% of independent shops, pubs, restaurants and cafes, by giving them annual savings of up to £8,000. Retailers have been struggling to compete with big tech companies, with a number of notable retailers recently having gone bust, while others have had to significantly reduce their operations.

The government hopes that these measures will help retail businesses grow. However, retailers will still have to contend with the speed and accessibility of online market places. While the continuing lack of disposable income available to consumers, caused by a decade of low real wage growth, remains an issue. It is unclear if these new measures, in light of issues faced by the retail sector and the uncertainties surrounding Brexit, will be enough to reinvigorate the high street in any meaningful way.

In the meantime, it will be interesting to see the conclusions of the consultation, the detailed plans of the tax and how it will be implemented. In addition, there is likely to be international pressure on the government to scrap the plans altogether. The US, where many of the big tech companies who are potentially affected are based, have urged against taking such unilateral action and may also have implications on negotiations for any trade deals with the US following Brexit.